Explorer Canopies

Our products are designed by our team here in Australia and we use the best available materials which are covered by a 12 month manufacturers warranty for extra peace of mind.

High quality ute canopies, dog boxes & Accessories designed to take on Australia’s toughest trails & conditions. Whether you are loading up your tools for a day on the job site or getting setup for your next big camp trip, we are here to make sure you have the right setup for all your gear to make it there and back home safely.

Give the team a call today and see which tray and canopy setup will best suite your needs 07 5599 3198 or visit our warehouse 5/63 Ourimbah rd, Tweed Heads, NSW

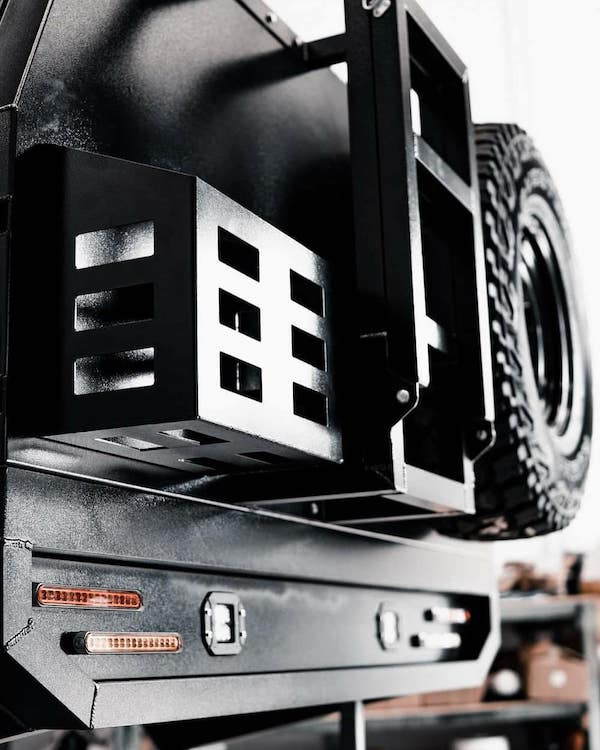

Accessories

Built for harsh conditions, our accessories are designed tough to withstand the extremes faced...

Featured products

-

1200mm Aluminium Canopy 2 Door - Black

Regular price $2,999.00 AUDRegular priceUnit price per$3,199.00 AUDSale price $2,999.00 AUDSale -

1600 Non Trundle Tray & 1200 Canopy

Regular price $8,273.00 AUDRegular priceUnit price per$9,413.00 AUDSale price $8,273.00 AUDSale -

1600 Non Trundle Tray & 800 Canopy

Regular price $7,823.00 AUDRegular priceUnit price per$9,158.00 AUDSale price $7,823.00 AUDSale -

1600 Non Trundle Tray & Canopy Package

Regular price $8,498.00 AUDRegular priceUnit price per$9,698.00 AUDSale price $8,498.00 AUDSale -

Sold out

Sold out1600 Trundle Tray & 800 Canopy

Regular price $8,474.00 AUDRegular priceUnit price per$10,658.00 AUDSale price $8,474.00 AUDSold out -

Sold out

Sold out1600 Trundle Tray & Canopy Package

Regular price $9,148.00 AUDRegular priceUnit price per$11,198.00 AUDSale price $9,148.00 AUDSold out -

1600 Trundle with 1600 2 Door Canopy & Accessories

Regular price $9,499.00 AUDRegular priceUnit price per$12,386.00 AUDSale price $9,499.00 AUDSold out -

Sale

Sale1600 Ute Tray Black

Regular price $4,599.00 AUDRegular priceUnit price per$5,499.00 AUDSale price $4,599.00 AUDSale

FAQ's

What type of utes do your trays and canopies fit?

Our ute tray packages are designed to fit most common dual cab Australian utes e.g Hilux, Dmax, Triton, Navara, Ranger, BT50, Colorado. Our canopies are all designed to work with our trays and match headboard profile. If you have a factory tray fitted to your ute already our canopies can be bolted directly to it and are designed to sit inside new factory tray tie down rails @ 1770mm

How do I know the trays and canopies are good quality?

Our trays and canopies are made of high quality marine grade aluminium and professionally manufactured and tested for structural strength. We also offer a 12 month warranty to back our products and services

Do you build custom canopies?

Yes. For a quote on a custom canopy please email info@explorercanopies.com.au with your measurements and requirements and we will get back to you. Please note custom canopies take much longer than our standard size stock canopies

Do you offer installation services?

Yes. We offer installation of ute trays and canopies including Tub removal, sensor & camera relocation and tail light wiring. Please check the products on our website for installation costs and details or contact us for pricing on installation

Do you offer freight within Australia?

Yes. We can freight our products Australia wide via the TNT network to a local depot near you for pickup. Please email info@explorercanopies.com.au or call 07 5599 3198 for a freight quote

Do you have finance available?

Yes! We have finance available with our partner Credit One. Please head to the finance page to enquire Click Here

-

“Thanks Explorer! I had a tub and canopy on the back for years and it was such a pain to get gear in and out of. Been using this for work and camp trips which has made my life soo much easier

James Handbrook – QLD 4806 -

“Extremely happy with the Canopy I bought through these guys. Very easy to deal with and kept in contact throughout the whole process! Would definitely recommend Explorer canopies – accomodating and friendly.

Ben Mortimer – NSW 2378

-

“Highly recommend great value and a good company to deal with had a small issue and the team at explorer canopies was more than happy to rectify in a prompt an professional manner, Thank you”

Joe mifsud – QLD 4227